Vancouver, BC / TNW-Accesswire / June 23 2014 / Golden Arrow Resources Corporation (TSX-V: GRG, FRA: GAC (WKN: A0B6XQ), "Golden Arrow" or the "Company") is pleased to announce additional results from the 9000 metre Phase III drill program at the Chinchillas Silver Project in Jujuy province, Argentina. Seven of the eight reported drill holes encountered significant mineralization, highlighting that the existing resource has substantial potential to grow. The holes targeted both step-outs to the existing resource and exploration of new areas.

"We are pleased with these latest results, and with the success of the drill program to date," commented Golden Arrow VP Exploration and Development Brian McEwen. "We are confident that we will increase resources at the project and position the Chinchillas deposit for a feasibility program."

Seven of the eight holes reported here encountered mineralization, including:

- 43 metres averaging 269 g/t silver and 2.8% lead at 98 metres depth in CGA-121, including 4 metres averaging 1218 g/t silver and 6.4% lead.

- 9 metres averaging 185 g/t silver and 2% lead at 59 metres depth in CGA-122, including 1 metre averaging 761 g/t silver and 6.3% lead.

- 14 metres averaging 187 g/t silver and 1.2% lead at 108 metres depth in CGA-122, including 3 metres at 594 g/t silver and 3% lead.

- 7 metres averaging 147 g/t silver and 3.8% lead at 182 metres depth in CGA-122, including 1 metre @ 577 g/t silver and 15.7% lead.

"Argentina continues to be an attractive mining destination. The recent $470 million investment by First Quantum Minerals to acquire a project in northern Argentina underlines the great potential of the country," commented Golden Arrow President and C.E.O., Joseph Grosso. "We believe this is another indication that Argentina's resource sector is set to grow, and the Chinchillas Project is positioned to grow along with it."

The Phase III drill program is designed to increase the existing resources at the Chinchillas deposit through exploration proximal to the deposit and in new areas of the properties. The program initially included a minimum of 6000 metres of diamond drilling, and this has been twice increased based on the positive results, for a new total of approximately 9000 metres. Drilling is now complete, for a total of 8985 metres. Table 1 below includes the results of 1682 metres of the completed drilling. Results for seven holes are still outstanding. Following a successful drill program, the Company plans to initiate an infill drilling program, followed by a feasibility study on the Chinchillas project by the end of 2014.

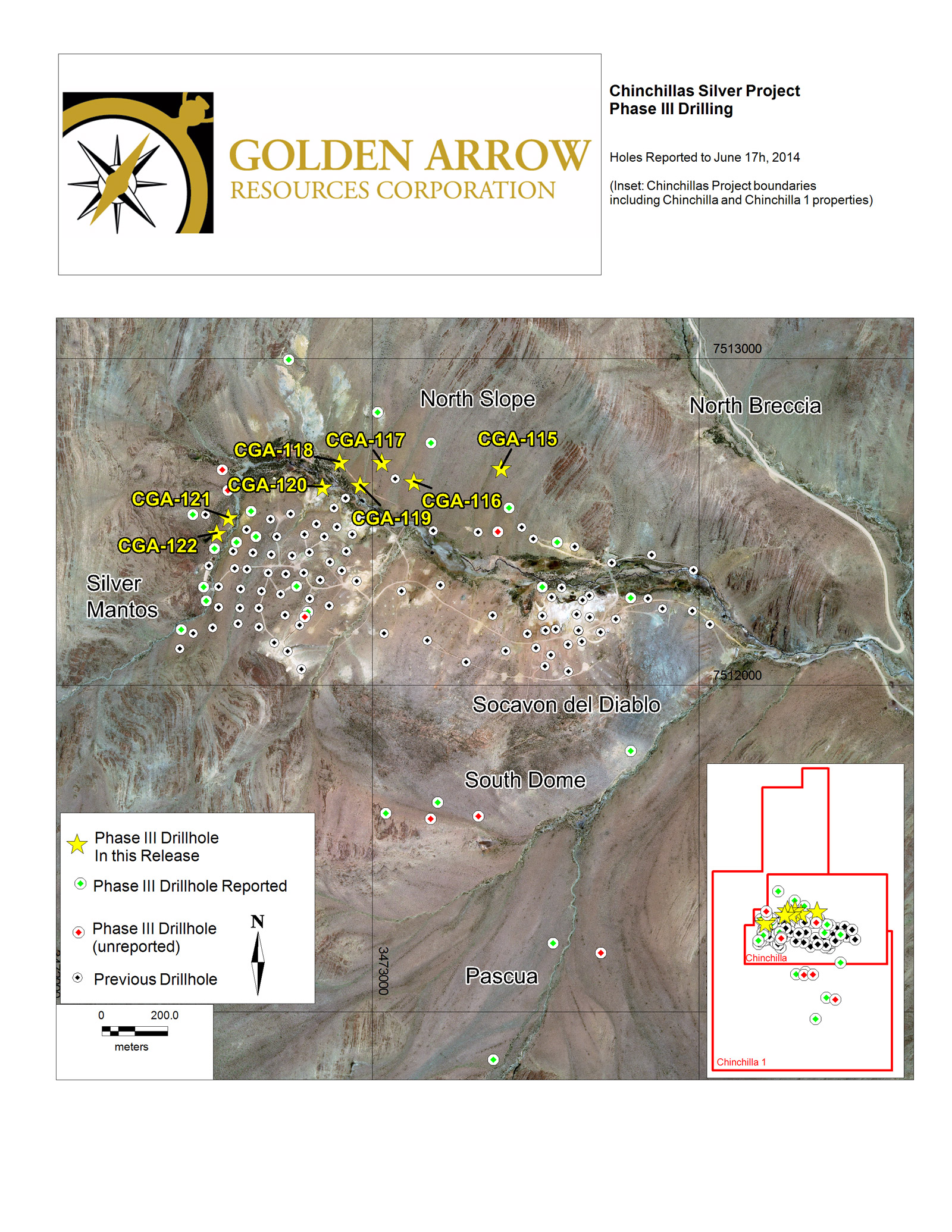

Corebox® interactive 3-D models of the deposit and drill holes can also be found on the website, here and will be updated with these new intercepts. A map of the drill hole locations will also be posted to the Chinchillas map page on the Golden Arrow website at http://www.goldenarrowresources.com/assets/news/Phase-III-NR4.jpg.

Drilling Details

Mineralized intercepts for nine drill holes are reported in Table 1. The Silver Mantos zone comprises the western portion of the deposit, while the Socavon del Diablo comprises the eastern portion. The Mantos Basement Zone is situated approximately below the Silver Mantos Zone. These zones were described in detail as part of the NI 43-101 Technical Report and resource estimate1. The North Slope is a newer target area along the slope of the basin to the north of both the Silver Mantos and Socavon Zones.

CGA-115 is located on the east side of the North Slope area, approximately 420 metres north of the main Socavon del Diablo resource zone. Some mineralized intervals were intersected in the basement; however, these are not expected to add to resources at this time.

Drill holes CGA-116, -117 and -119 are in the North Slope area, northeast of the Silver Mantos resource zone. CGA-118 and CGA-120 are on the northern margin of the Silver Mantos resource area, just below the North Slope. With the exception of the shallow hole CGA-118, all holes successfully encountered mineralization. Hole CGA-116 was mineralized in the upper mantos-style tuffs, in the basement, and most strongly in interspersed dacite units, which may be an indication of mineralized structures that suggest additional work. Mineralization in all other holes was in the upper tuff units similar to the existing Silver Mantos resource. These results are expected to allow the expansion of resources from the previous Silver Mantos zone up the North Slope through to the previously reported hole CGA-105, a lateral distance of approximately 300 metres to the northeast.

CGA-121 and CGA-122 are located approximately 50 metres to the west of the Silver Mantos resource zone. Both holes were well mineralized, particularly in the Mantos Basement unit, and the results obtained will expand the Silver Mantos and Mantos Basement resource units to the west.

Table 1. Drill Intercepts >20g/t for Ag and >0.5% for Pb and Zn

| TARGET / ZONE | HOLE ID | NOTES | FROM (metres) | TO (metres) | Interval (metres) | Ag (g/t) | Pb (%) |

Zn (%) |

Ag Eq. (g/t) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NORTH SLOPE | CGA-115 | 20.75 | 25 | 4.3 | 51 | 51 | ||||||||

| 93.1 | 95 | 1.9 | 39 | 0.7 | 62 | |||||||||

| 110 | 114 | 4.0 | 176 | 4.8 | 331 | |||||||||

| NORTH SLOPE | CGA-116 | 11 | 13 | 2.0 | 91 | 91 | ||||||||

| 18 | 19 | 1.0 | 64 | 64 | ||||||||||

| 28 | 32 | 4.0 | 53 | 53 | ||||||||||

| 143 | 145 | 2.0 | 49 | 1.5 | 97 | |||||||||

| 162 | 163 | 1.0 | 47 | 1.3 | 1 | 121 | ||||||||

| 165 | 167 | 2.0 | 0.7 | 23 | ||||||||||

| 185 | 187 | 2.0 | 82 | 2.4 | 159 | |||||||||

| 194 | 195 | 1.0 | 83 | 2.5 | 164 | |||||||||

| 206 | 210 | 4.0 | 137 | 2.7 | 0.6 | 243 | ||||||||

| 221 | 222 | 1.0 | 62 | 62 | ||||||||||

| 228 | 233 | 5.0 | 21 | 21 | ||||||||||

| 253 | 254 | 1.0 | 193 | 193 | ||||||||||

| 263 | 264 | 1.0 | 119 | 2.6 | 203 | |||||||||

| 267 | 268 | 1.0 | 25 | 0.6 | 44 | |||||||||

| 280 | 281.8 | 1.8 | 92 | 1.4 | 137 | |||||||||

| 289 | 291 | 2.0 | 46 | 46 | ||||||||||

| 295 | 297 | 2.0 | 0.9 | 29 | ||||||||||

| NORTH SLOPE | CGA-117 | 6 | 7 | 1.0 | 24 | 24 | ||||||||

| 10 | 12 | 2.0 | 20 | 20 | ||||||||||

| 29 | 30 | 1.0 | 32 | 32 | ||||||||||

| 82 | 84 | 2.0 | 32 | 32 | ||||||||||

| 112 | 113 | 1.0 | 29 | 1.1 | 64 | |||||||||

| SILVER MANTOS | CGA-118 | no significant mineralization | ||||||||||||

| NORTH SLOPE | CGA-119 | 15 | 28 | 13.0 | 58 | 1.4 | 103 | |||||||

| 37.4 | 41 | 3.6 | 2 | 64 | ||||||||||

| 41 | 53 | 12.0 | 79 | 1.5 | 1.8 | 185 | ||||||||

| 53 | 75 | 22.0 | 3.3 | 106 | ||||||||||

| 75 | 86 | 11.0 | 73 | 1.6 | 125 | |||||||||

| 86 | 100 | 14.0 | 1.1 | 35 | ||||||||||

| includes | 92 | 93 | 1.0 | 47 | 3.3 | 153 | ||||||||

| and | 96 | 100 | 4.0 | 36 | 1 | 68 | ||||||||

| 138 | 155 | 17.0 | 1.6 | 52 | ||||||||||

| includes | 146 | 148 | 2.0 | 178 | 1.1 | 213 | ||||||||

| 159 | 160 | 1.0 | 29 | 0.7 | 52 | |||||||||

| 166 | 167 | 1.0 | 30 | 30 | ||||||||||

| SILVER MANTOS | CGA-120 | 17 | 18.35 | 1.35 | 96 | 96 | ||||||||

| 48 | 59 | 11.0 | 43 | 0.8 | 0.5 | 85 | ||||||||

| 65 | 71 | 6.0 | 47 | 0.7 | 0.7 | 92 | ||||||||

| 73 | 98 | 25.0 | 46 | 0.7 | 69 | |||||||||

| 111 | 112 | 1.0 | 78 | 1.4 | 1.1 | 159 | ||||||||

| SILVER MANTOS | CGA-121 | 87 | 93 | 6.0 | 52 | 52 | ||||||||

| MANTOS BASEMENT | CGA-121 | 98 | 141 | 43.0 | 269 | 2.8 | 359 | |||||||

| includes | 100 | 104 | 4.0 | 1218 | 6.4 | 1,424 | ||||||||

| and | 137 | 138 | 1.0 | 621 | 9 | 911 | ||||||||

| 142 | 143 | 1.0 | 25 | 0.6 | 0.6 | 64 | ||||||||

| 147 | 148 | 1.0 | 47 | 1.2 | 86 | |||||||||

| 151 | 167 | 16.0 | 123 | 1 | 155 | |||||||||

| 176 | 185 | 9.0 | 47 | 47 | ||||||||||

| 187 | 189 | 2.0 | 24 | 0.8 | 50 | |||||||||

| SILVER MANTOS | CGA-122 | 36 | 37 | 1.0 | 45 | 45 | ||||||||

| 45 | 47 | 2.0 | 235 | 0.8 | 261 | |||||||||

| MANTOS BASEMENT | CGA-122 | 59 | 68 | 9.0 | 185 | 2 | 249 | |||||||

| includes | 63 | 64 | 1.0 | 761 | 6.3 | 964 | ||||||||

| 85 | 91 | 6.0 | 28 | 28 | ||||||||||

| 93 | 95 | 2.0 | 260 | 1.5 | 308 | |||||||||

| 97 | 100 | 3.0 | 56 | 0.6 | 75 | |||||||||

| 102 | 105 | 3.0 | 34 | 34 | ||||||||||

| 108 | 122 | 14.0 | 187 | 1.2 | 226 | |||||||||

| includes | 115 | 118 | 3.0 | 594 | 3 | 691 | ||||||||

| 124 | 125 | 1.0 | 49 | 49 | ||||||||||

| 127 | 140 | 13.0 | 51 | 1.6 | 103 | |||||||||

| 151 | 158 | 7.0 | 71 | 0.8 | 97 | |||||||||

| 161 | 164 | 3.0 | 30 | 0.6 | 49 | |||||||||

| 182 | 189 | 7.0 | 147 | 3.8 | 269 | |||||||||

| includes | 187 | 188 | 1.0 | 577 | 15.7 | 1,083 | ||||||||

| The reported intervals are believed to approximate true width and will be confirmed with geologic modeling. Silver Equivalent grades (AgEQ) were calculated using US$20/oz. for silver, US$0.94/lb. for lead and US$0.94/lb. for zinc. |

||||||||||||||

Methodology and QA/QC

Analyses of the drill core were performed by Alex Stewart Assayers, in Mendoza, Argentina, an internationally recognized assay service provider. All samples were analyzed by method ICP-MA-39 that consists of a four acid digestion followed by ICP-OES detection. Silver results >200 Ag g/t were re-analyzed by fire assay with a gravimetric finish on 50-gram samples. Lead and zinc results >10,000 ppm were re-analyzed by a 3 acids and ICP-OES detection. The Company followed industry standard procedures for the work carried out on the Chinchillas Project, with a quality assurance/quality control (QA/QC) program. Blank, duplicate and standard samples were inserted into the drill core sample sequence sent to the laboratory for analysis. Golden Arrow detected no significant QA/QC issues during review of the data.

Table 2. Drill hole location and orientation data

| Hole ID | Easting | Northing | Elevation (m) | Azimuth | Inclination | Length (m) |

|---|---|---|---|---|---|---|

| CGA-115 | 3473395 | 7512665 | 4136 | 0 | -90 | 320 |

| CGA-116 | 3473127 | 7512624 | 4102 | 20 | -70 | 320 |

| CGA-117 | 3473028 | 7512683 | 4107 | 314 | -70 | 150 |

| CGA-118 | 3472899 | 7512684 | 4097 | 0 | -90 | 80 |

| CGA-119 | 3472962 | 7512614 | 4091 | 0 | -90 | 191 |

| CGA-120 | 3472847 | 7512608 | 4093 | 0 | -90 | 149 |

| CGA-121 | 3472559 | 7512514 | 4115 | 0 | -90 | 221 |

| CGA-122 | 3472523 | 7512467 | 4120 | 0 | -90 | 251 |

About the Chinchillas Silver Project

Golden Arrow is earning a 100% interest in the Chinchillas Silver Project. After less than two years exploration, the Company announced a NI 43-101 resource estimate1 in 2013, including:

- 27.4 Moz silver / 32.6 Moz silver equivalent in Indicated Resources (7.2 Mt @ 119g/t silver, 0.57% lead, 0.48% zinc : 141g/t silver equivalent )

- 53 Moz silver / 72.2 Moz silver equivalent in Inferred Resources (21 Mt @ 78.5 g/t silver, 0.69% lead, 0.62% zinc : 107g/t silver equivalent)

The first NI 43-101 preliminary economic assessment2 returned an after-tax NPV 8% of US$98.5M, highlighting the benefits of the project's near-surface mineralization, conventional metallurgy and access to infrastructure. The deposit is open to expansion and Golden Arrow is now drilling to increase resources.

- "Mineral Resource Estimate for the Chinchillas Silver-Lead-Zinc Project, Jujuy Province, Argentina" filed on SEDAR dated June 20th, 2013.

- "Preliminary Economic Assessment for the Chinchillas Silver-Lead-Zinc Project, Jujuy Province, Argentina" filed on SEDAR dated January 20th, 2014.

Qualified Persons

The contents of the news release have been reviewed and approved by Brian McEwen, P.Geol., VP Exploration and Development to the Company, and a Qualified Person as defined in National Instrument 43-101.

About Golden Arrow:

Golden Arrow is a Vancouver-based explorer focused on identifying, acquiring and advancing precious and base metal projects in Argentina with the goal of achieving a world class discovery. The main focus is on advancing the flagship Chinchillas Silver Project located in Jujuy, Argentina. Golden Arrow has a strong treasury which will allow the company to advance its Chinchillas Silver Project. Golden Arrow will continue to execute its strategy to leverage the Company's exploration exposure by attracting partners to fund work on its other high quality mineral projects. Golden Arrow is a member of Grosso Group, a management company specialized in resource exploration, and working in Argentina where it is highly regarded and trusted since 1993.

ON BEHALF OF THE BOARD

"Joseph Grosso"

_______________________________

Mr. Joseph Grosso

Executive Chairman, President, CEO and Director

For further information please contact:

Corporate Communications

Tel: 1-604-687-1828

Toll-Free: 1-800-901-0058

Email: info@goldenarrowresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of Canadian securities legislation. Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of the Chinchillas project, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on expectations of future performance as outlined in the PEA, including silver, lead and zinc production and planned work programs at Chinchillas. Statements concerning reserves and mineral resource estimates may also constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the Chinchillas property is developed and, in the case of mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation: risks related to precious and base metal price fluctuations; risks related to fluctuations in the currency markets (particularly the Argentinean peso, Canadian dollar and United States dollar); risks related to the inherently dangerous activity of mining, including conditions or events beyond our control, and operating or technical difficulties in mineral exploration, development and mining activities; uncertainty in the Company's ability to raise financing and fund the development of the Chinchillas project pursuant to the PEA; uncertainty as to actual capital costs, operating costs, production and economic returns, and uncertainty that development activities will result in a profitable mining operation at Chinchillas; risks related to mineral resource figures being estimates based on interpretations and assumptions which may result in less mineral production under actual conditions than is currently estimated and to diminishing quantities or grades of mineral resources as properties are mined; risks related to governmental regulations and obtaining necessary licenses and permits; risks related to the business being subject to environmental laws and regulations which may increase costs of doing business and restrict our operations; risks related to the Chinchillas property being subject to prior unregistered agreements, transfers, or claims and other defects in title; risks relating to inadequate insurance or inability to obtain insurance; risks related to potential litigation; risks related to the global economy; risks related to the Chinchillas property being located in Argentina, including political, economic, social and regulatory instability. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. The Company's forward-looking statements are based on beliefs, expectations and opinions of management on the date the statements are made. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

The information provided in this news release addresses the Chinchillas PEA and is not intended to be a comprehensive review of all matters and developments concerning the Company. It should be read in conjunction with all other disclosure documents of the Company. The information contained herein is not a substitute for detailed investigation or analysis. No securities commission or regulatory authority has reviewed the accuracy or adequacy of the information presented. The Company undertakes no obligation to publicly update or revise any forward-looking statements.

We advise U.S. investors that the SEC's mining guidelines strictly prohibit information of this type in documents filed with the SEC. U.S. investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on our properties.